Marcus White

Bold Penguin

Context

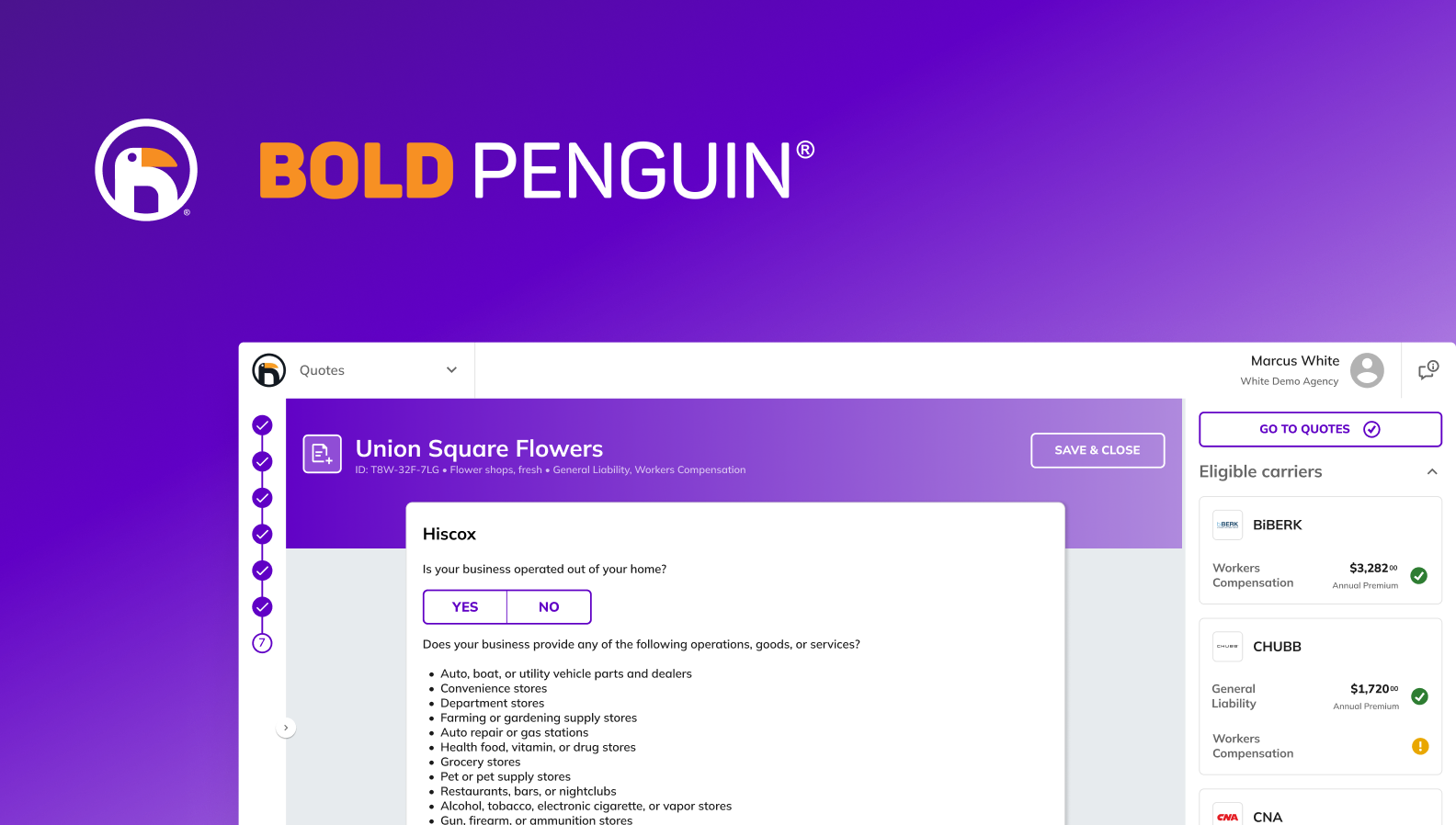

Bold Penguin’s core quoting platform, (aka Terminal) enables commercial insurance agents to quickly quote and bind policies from multiple carriers through a single, streamlined digital platform. It requires users to complete every carrier questionnaire before seeing any quotes—a friction point for agents managing multiple carriers.

Problem

Agents were abandoning applications due to the time and effort required without seeing any payoff (quotes).

Goal

Increase application completion rate and speed by showing real-time quote eligibility as users progressed.

Role

Product Designer

Team:

1 Product Designer

1 Design Manager

1 Product Owner

1 Director of Product 1 Engineering Team

Timeline:

Q2 2022

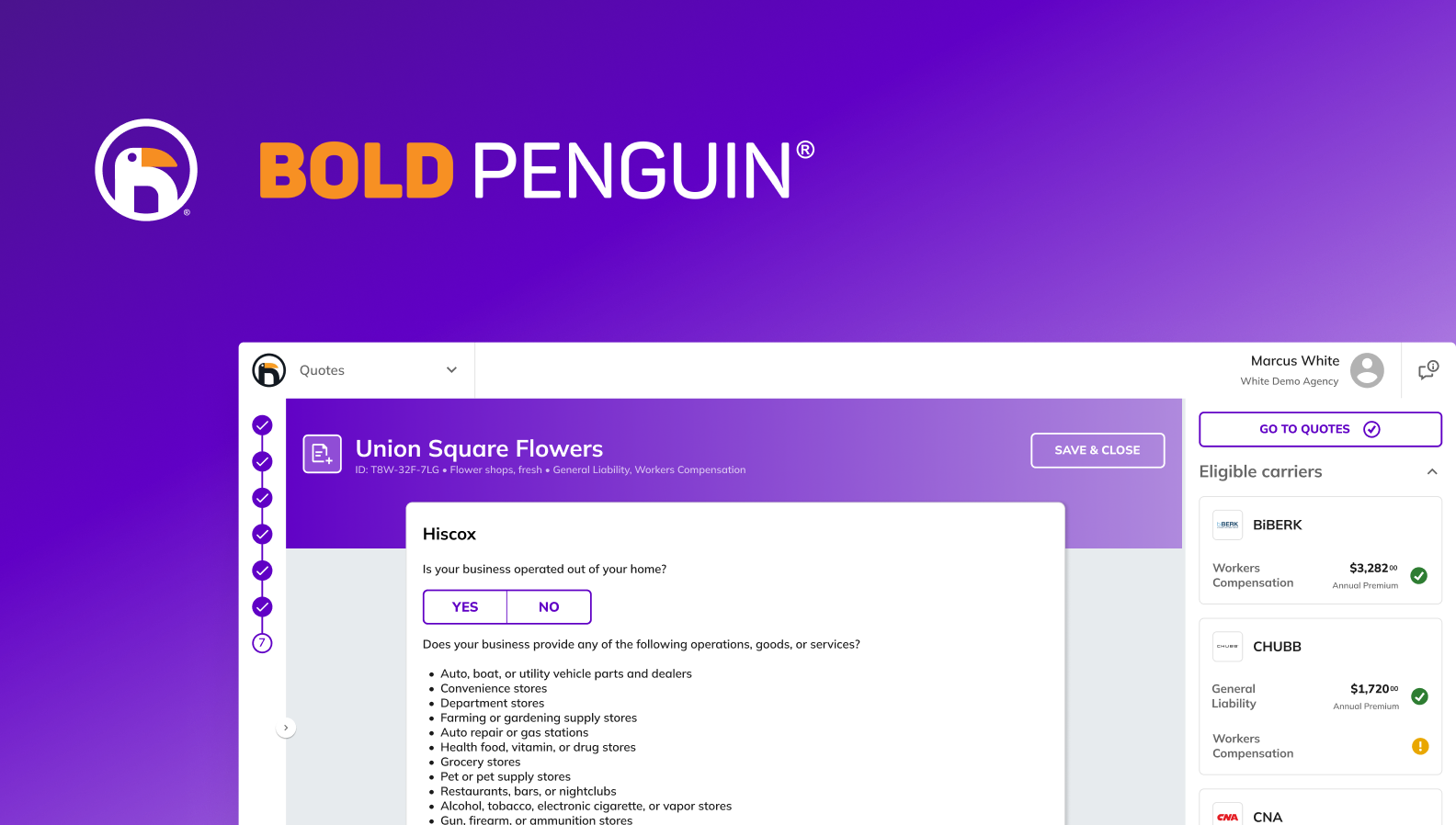

Final result preview

View Live Prototype

Discovery

What we started with

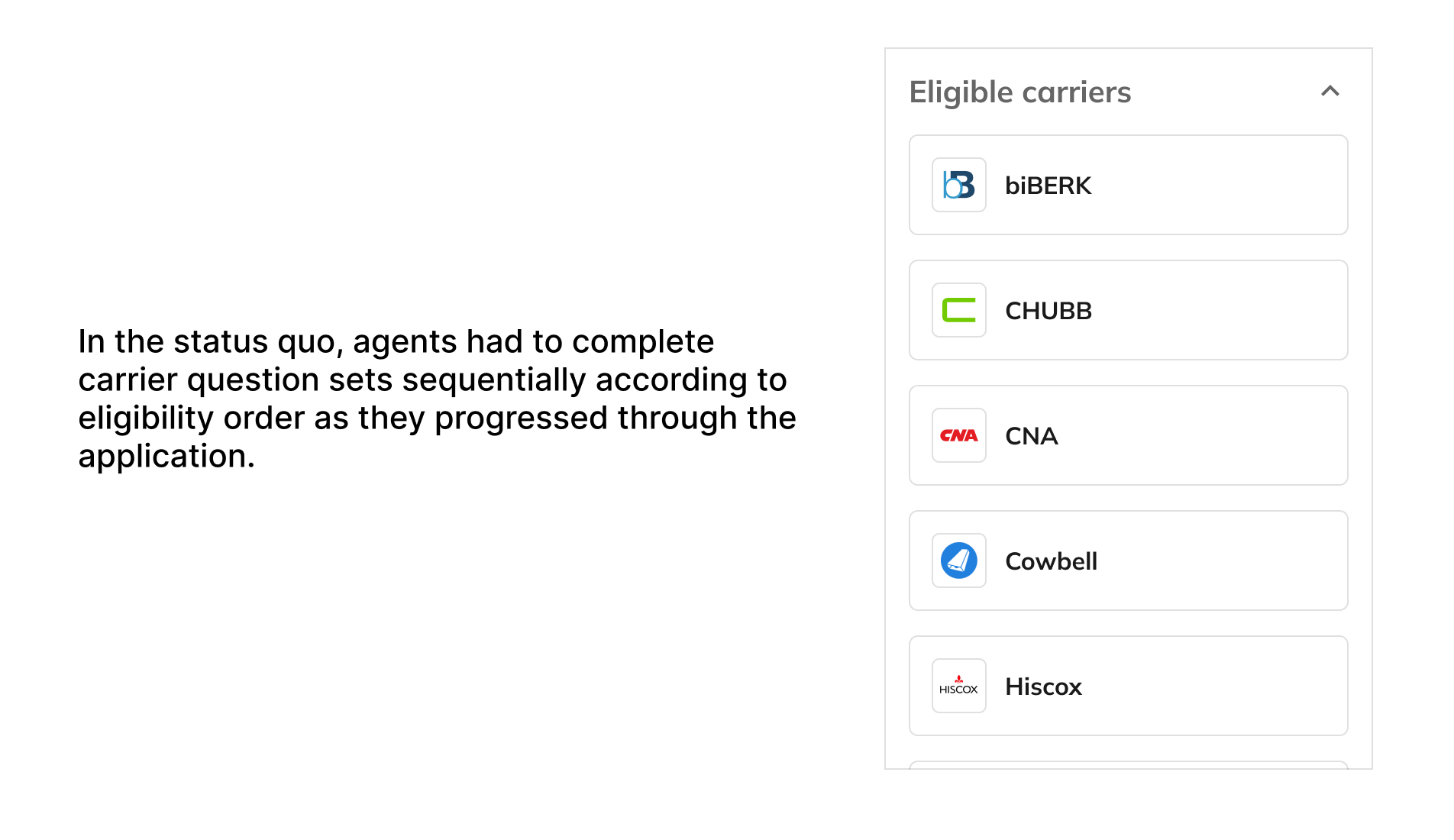

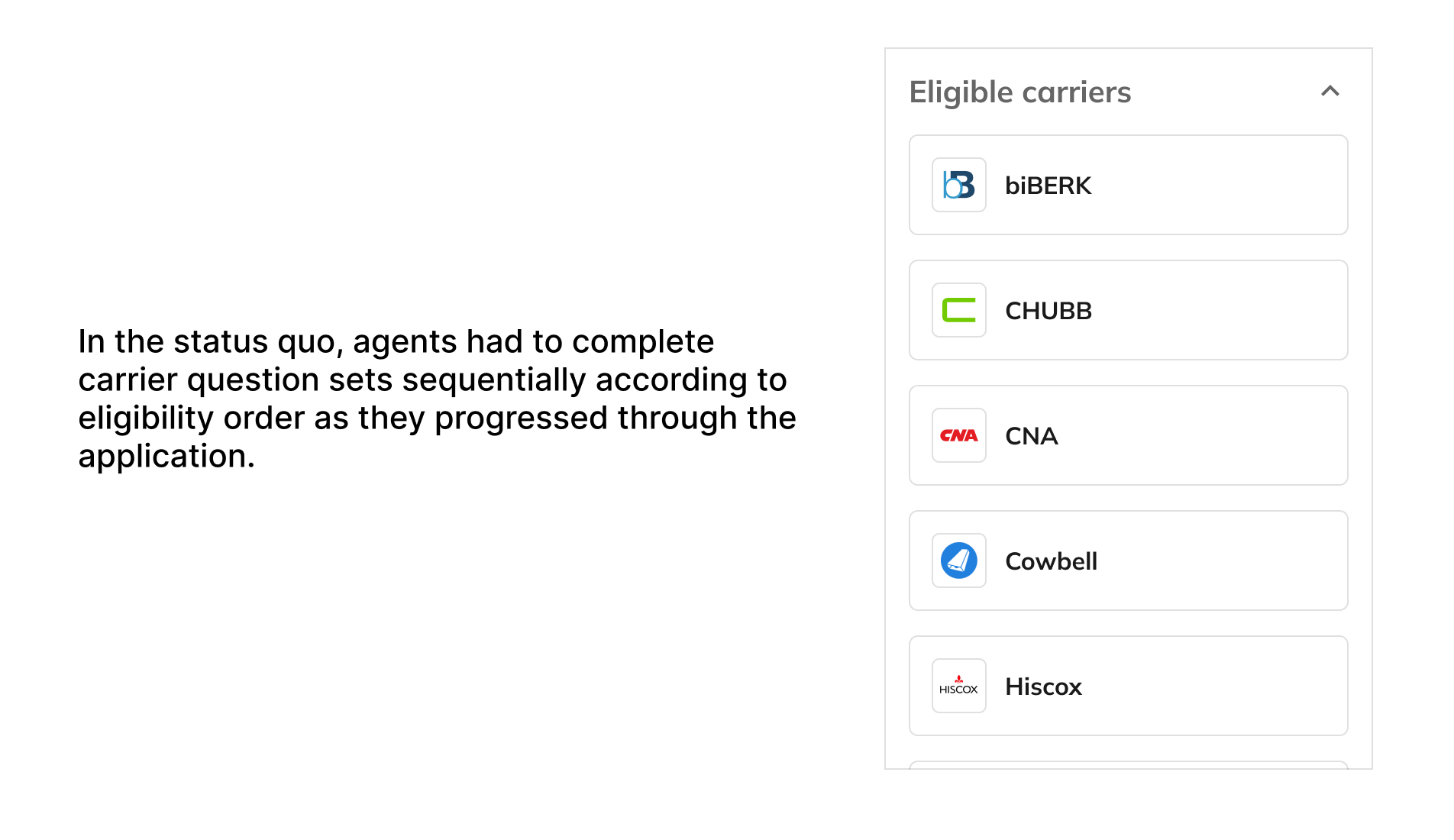

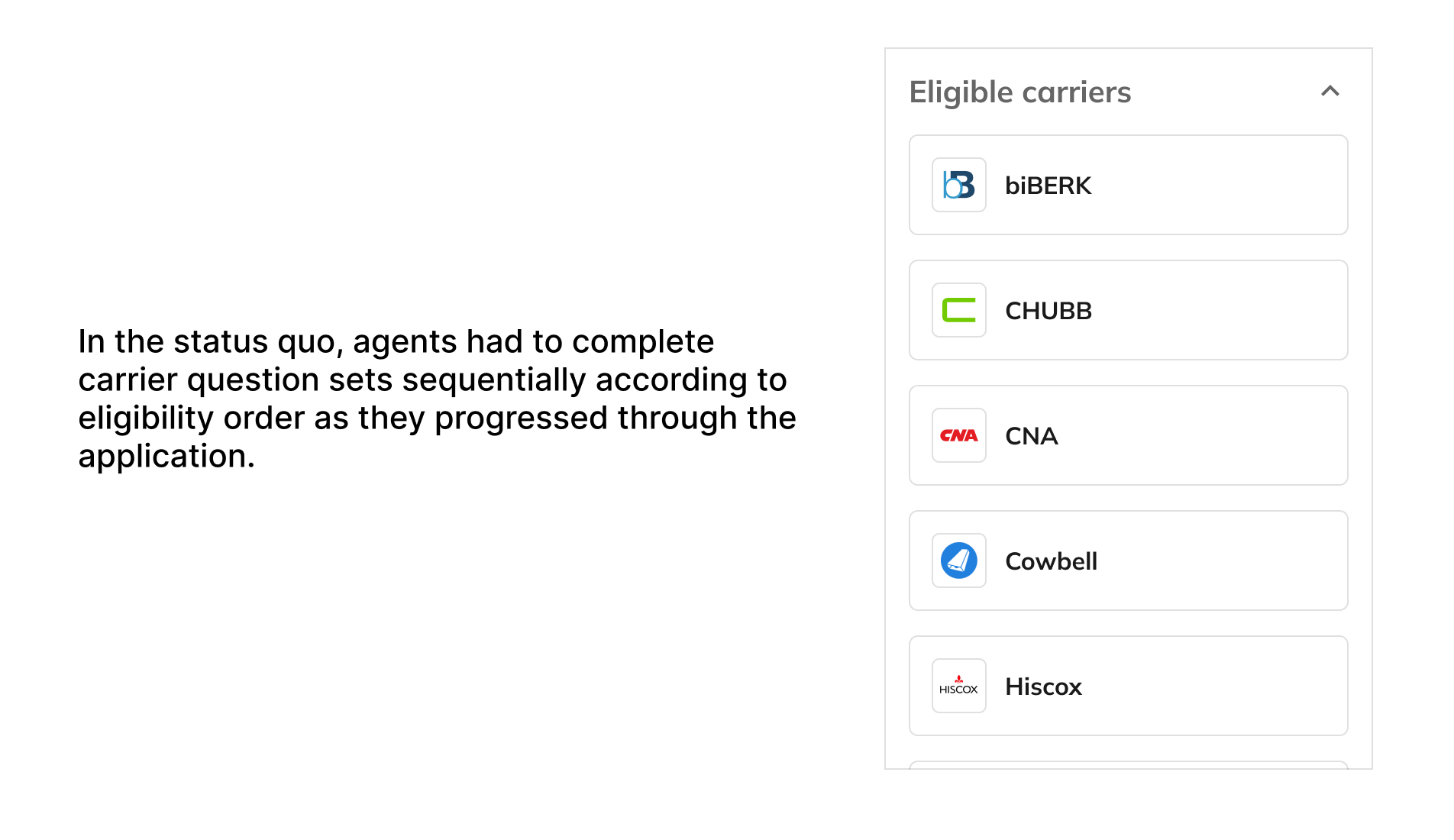

- A rigid, linear quoting process where agents had to complete all carrier question sets before seeing any quotes.

- High abandonment rates and frustration among agents due to lack of transparency and unnecessary work.

- A feature (real-time quote eligibility) that had been sitting in the backlog for over a year.

What was created and the thought process behind it

- Mapped out the existing application journey to visualize bottlenecks.

- Identified user pain points through internal interviews and analytics: too many steps, no quote visibility early, and wasted effort.

- Proposed introducing real-time visibility into the quote eligibility process by unlocking carrier quotes dynamically as relevant data was entered.

What we delivered

- Initial hypotheses around skipping carriers, and early flows that would allow faster decision-making and less friction.

Initial Design Review

What we started with

- Key design problem: how to allow agents to skip or jump between carriers without breaking logic or creating confusion.

What was created and the thought process behind it

- Designed two user flows:

- Traditional path with all carriers filled out.

- Optimized path with skippable carrier question sets.

- Created early mockups showing:

- How carrier cards would behave in the Real-time Eligibility Panel (RTE).

- What quote statuses would look like (e.g., incomplete, skipped, pending, quoted).

- Considered future edge cases like multi-product quotes (e.g., GL + WC from one carrier) and tackled vertical space constraints.

What we delivered

- A working prototype and conceptual framework for:

- Skipping carrier sets.

- Jumping between carriers.

- Grouping multiple quotes from one carrier into a single expandable card.

- A strong foundation for stakeholder review and usability testing.

Feedback Design Review

What we started with

- A high-fidelity prototype demonstrating:

- Carrier skipping.

- Real-time updates to the quote panel.

- Early attempts at status indicators and user flows.

What was created and the thought process behind it

- Conducted 6 feedback sessions (participated in 5) with enterprise clients including InsureCherokee.

- Gathered direct user insights:

- Skipping to competitive carriers was highly praised.

- Request for showing estimated pricing sooner.

- Suggestions for grouping by carrier and clarity on multi-coverage display.

- Iterated based on feedback:

- Simplified visual hierarchy.

- Enhanced iconography and label clarity.

- Removed clutter by consolidating coverage types into single cards.

What we delivered

- A refined, clickable high-fidelity prototype that:

- Addressed agent pain points around speed and control.

- Was visually clear and aligned with Bold Penguin’s brand and technical constraints.

- Was validated by enthusiastic user feedback and cleared for engineering build-out.

Final Outcome & Results

View Live Prototype

What was shipped

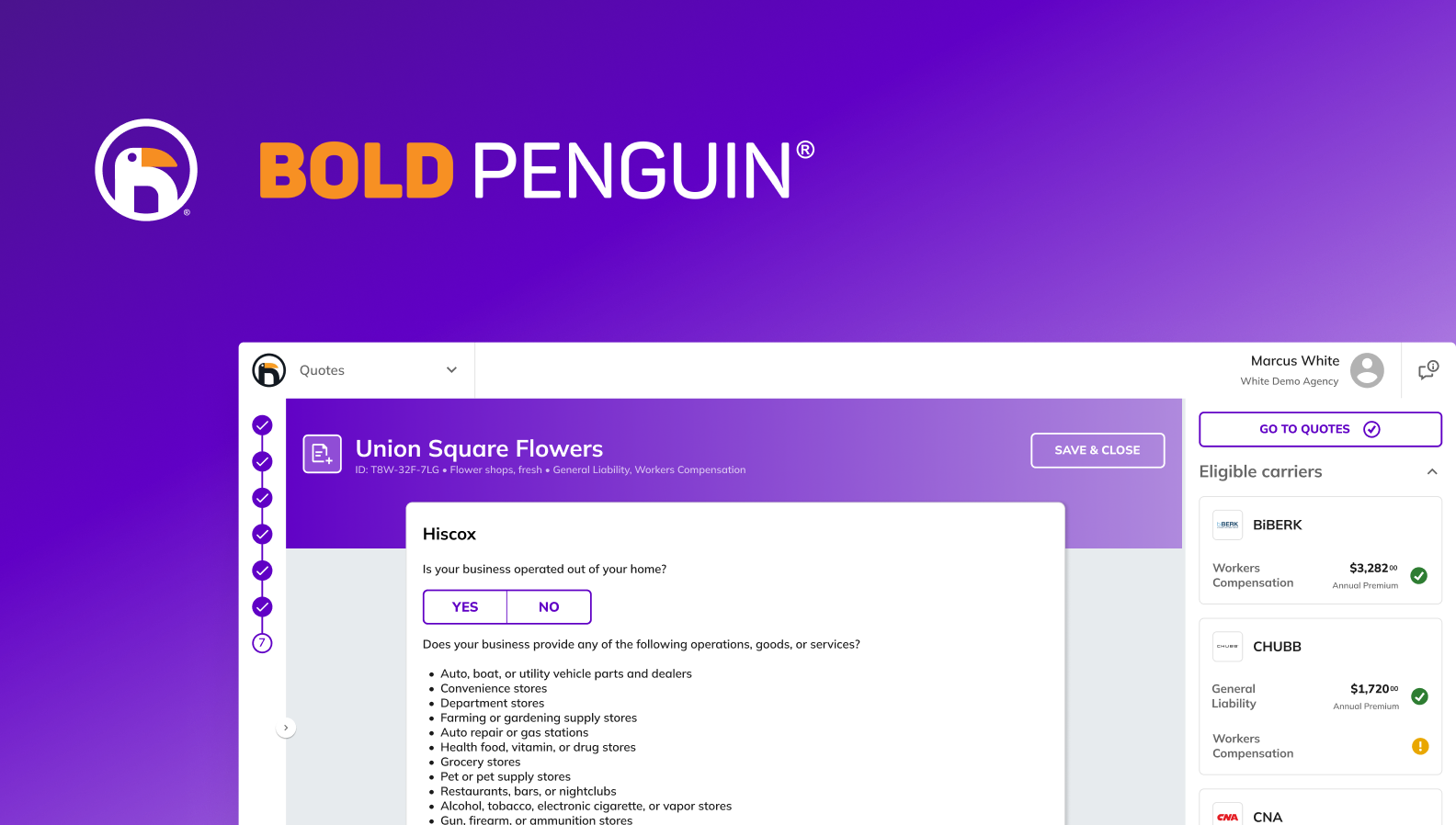

- Launched a new Real-Time Eligibility (RTE) Panel inside the Bold Penguin Terminal.

- Enabled live carrier quotes to populate dynamically as users filled out relevant fields—no need to complete all question sets first.

- Delivered full functionality to:

- Skip non-competitive or unnecessary carrier question sets.

- Jump between incomplete and completed carriers.

- View grouped multi-coverage quotes within a single carrier card.

- Built with edge-case handling for:

- Incomplete carriers.

- Error messaging and quote timeouts.

- Returning to edit responses and retrieve new quotes.

The business value

- Conversion Rate

- Minutes to quote for The Traditional Path: 9 min, 38 seconds average.

- Minutes to quote for The Modern Path: 2 min, 56 seconds average. (70% reduction in time in Q4 2022)

- Feature Adoption Rate

- Total application starts in Q4 2022: 20,607

- The Traditional Path we defined as the status quo: 19,577

- The Modern Path we defined as the new feature: 1,030 (5% pilot feature adoption rate)

- Longer term Feature Adoption Rate

- Total application starts from Q1 2023 - Q2 2025: 124,709

- The Traditional Path we defined as the status quo: 103,513

- The Modern Path we defined as the new feature: 21,190 (17% sustained average feature adoption rate)

- Helped Bold Penguin strengthen its position as an efficient quoting solution in a competitive insurtech market.

The user value

- Time to First Value (TTFV):

- Improved the agents' time to first value by reducing quote delivery time within the application by 70%

- Empowered agents to:

- Focus on competitive carriers early in the process.

- Save time by skipping low-value carriers.

- Increased clarity and confidence for agents with a clean, informative quote display.

- Enhanced usability and accessibility via simplified flows, clearer iconography, and flexible navigation.

The data supporting the value delivered

- Application time-to-quote reduced by 70% in Q4 2022 which significantly improved our agents' ability to complete applications faster.

- Positive user sentiment from 6 research sessions, with multiple mentions of increased speed and usability.

- From Q1 2023 - Q2 2025, the Feature Adoption Rate reached its highest at 22% in Q2 2024 and sustained at an average rate of 17% percent throughout the pass 3 years of usage.

Reflection

What worked well

- Stakeholder Alignment: I learned how to build trust with multiple stakeholders, from product leadership to engineers. Clear prototypes and a collaborative mindset helped secure buy-in at key decision points.

- Problem-Solving in a Complex System: Navigating a multi-carrier, multi-product quoting flow required deep understanding of edge cases. Our solution simplified a notoriously complex process into something scalable and intuitive.

- User-Driven Design: Participating in five out of six customer feedback sessions allowed me to integrate user insights directly into the iteration loop, which led to greater adoption and satisfaction.

What could be improved

- Earlier Involvement of Engineering in Design Decisions: While we collaborated well overall, some engineering edge cases surfaced late. Looping in developers sooner during ideation could have reduced refinement time later.

- Quantifying Impact Sooner: We didn't define our success metrics (like quote yield, time-to-quote) early enough in the project. This limited our ability to do A/B testing or track immediate ROI post-launch.

- Scalability of the RTE Panel Design: As new carriers and coverage types are added, the current design may need updates to handle overflow or new logic—something we could have stress-tested further in early rounds.

- Post-Launch Customer Awareness: We could have done more to market the feature to existing customers after release. While the feature delivered real value. long term limited visibility may have slowed broader adoption. A coordinated enablement effort with Customer Success and Marketing could have amplified awareness and usage.

Marcus White

Home

Bold Penguin

Real-time quote eligibility

Context

Bold Penguin’s core quoting platform, (aka Terminal) enables commercial insurance agents to quickly quote and bind policies from multiple carriers through a single, streamlined digital platform. It requires users to complete every carrier questionnaire before seeing any quotes—a friction point for agents managing multiple carriers.

Problem

Agents were abandoning applications due to the time and effort required without seeing any payoff (quotes).

Goal

Increase application completion rate and speed by showing real-time quote eligibility as users progressed.

Role

Product Designer

Team:

1 Product Designer

1 Design Manager

1 Product Owner

1 Director of Product 1 Engineering Team

Timeline:

Q2 2022

Final result preview

View Live Prototype

Discovery

What we started with

- A rigid, linear quoting process where agents had to complete all carrier question sets before seeing any quotes.

- High abandonment rates and frustration among agents due to lack of transparency and unnecessary work.

- A feature (real-time quote eligibility) that had been sitting in the backlog for over a year.

What was created and the thought process behind it

- Mapped out the existing application journey to visualize bottlenecks.

- Identified user pain points through internal interviews and analytics: too many steps, no quote visibility early, and wasted effort.

- Proposed introducing real-time visibility into the quote eligibility process by unlocking carrier quotes dynamically as relevant data was entered.

What we delivered

- Initial hypotheses around skipping carriers, and early flows that would allow faster decision-making and less friction.

Initial Design Review

What we started with

- Key design problem: how to allow agents to skip or jump between carriers without breaking logic or creating confusion.

What was created and the thought process behind it

- Designed two user flows:

- Traditional path with all carriers filled out.

- Optimized path with skippable carrier question sets.

- Created early mockups showing:

- How carrier cards would behave in the Real-time Eligibility Panel (RTE).

- What quote statuses would look like (e.g., incomplete, skipped, pending, quoted).

- Considered future edge cases like multi-product quotes (e.g., GL + WC from one carrier) and tackled vertical space constraints.

What we delivered

- A working prototype and conceptual framework for:

- Skipping carrier sets.

- Jumping between carriers.

- Grouping multiple quotes from one carrier into a single expandable card.

- A strong foundation for stakeholder review and usability testing.

Feedback Design Review

What we started with

- A high-fidelity prototype demonstrating:

- Carrier skipping.

- Real-time updates to the quote panel.

- Early attempts at status indicators and user flows.

What was created and the thought process behind it

- Conducted 6 feedback sessions (participated in 5) with enterprise clients including InsureCherokee.

- Gathered direct user insights:

- Skipping to competitive carriers was highly praised.

- Request for showing estimated pricing sooner.

- Suggestions for grouping by carrier and clarity on multi-coverage display.

- Iterated based on feedback:

- Simplified visual hierarchy.

- Enhanced iconography and label clarity.

- Removed clutter by consolidating coverage types into single cards.

What we delivered

- A refined, clickable high-fidelity prototype that:

- Addressed agent pain points around speed and control.

- Was visually clear and aligned with Bold Penguin’s brand and technical constraints.

- Was validated by enthusiastic user feedback and cleared for engineering build-out.

Final Outcome & Results

View Live Prototype

What was shipped

- Launched a new Real-Time Eligibility (RTE) Panel inside the Bold Penguin Terminal.

- Enabled live carrier quotes to populate dynamically as users filled out relevant fields—no need to complete all question sets first.

- Delivered full functionality to:

- Skip non-competitive or unnecessary carrier question sets.

- Jump between incomplete and completed carriers.

- View grouped multi-coverage quotes within a single carrier card.

- Built with edge-case handling for:

- Incomplete carriers.

- Error messaging and quote timeouts.

- Returning to edit responses and retrieve new quotes.

The business value

- Conversion Rate

- Minutes to quote for The Traditional Path: 9 min, 38 seconds average.

- Minutes to quote for The Modern Path: 2 min, 56 seconds average. (70% reduction in time in Q4 2022)

- Feature Adoption Rate

- Total application starts in Q4 2022: 20,607

- The Traditional Path we defined as the status quo: 19,577

- The Modern Path we defined as the new feature: 1,030 (5% pilot feature adoption rate)

- Longer term Feature Adoption Rate

- Total application starts from Q1 2023 - Q2 2025: 124,709

- The Traditional Path we defined as the status quo: 103,513

- The Modern Path we defined as the new feature: 21,190 (17% sustained average feature adoption rate)

- Helped Bold Penguin strengthen its position as an efficient quoting solution in a competitive insurtech market.

The user value

- Time to First Value (TTFV):

- Improved the agents' time to first value by reducing quote delivery time within the application by 70%

- Empowered agents to:

- Focus on competitive carriers early in the process.

- Save time by skipping low-value carriers.

- Increased clarity and confidence for agents with a clean, informative quote display.

- Enhanced usability and accessibility via simplified flows, clearer iconography, and flexible navigation.

The data supporting the value delivered

- Application time-to-quote reduced by 70% in Q4 2022 which significantly improved our agents' ability to complete applications faster.

- Positive user sentiment from 6 research sessions, with multiple mentions of increased speed and usability.

- From Q1 2023 - Q2 2025, the Feature Adoption Rate reached its highest at 22% in Q2 2024 and sustained at an average rate of 17% percent throughout the pass 3 years of usage.

Reflection

What worked well

- Stakeholder Alignment: I learned how to build trust with multiple stakeholders, from product leadership to engineers. Clear prototypes and a collaborative mindset helped secure buy-in at key decision points.

- Problem-Solving in a Complex System: Navigating a multi-carrier, multi-product quoting flow required deep understanding of edge cases. Our solution simplified a notoriously complex process into something scalable and intuitive.

- User-Driven Design: Participating in five out of six customer feedback sessions allowed me to integrate user insights directly into the iteration loop, which led to greater adoption and satisfaction.

What could be improved

- Earlier Involvement of Engineering in Design Decisions: While we collaborated well overall, some engineering edge cases surfaced late. Looping in developers sooner during ideation could have reduced refinement time later.

- Quantifying Impact Sooner: We didn't define our success metrics (like quote yield, time-to-quote) early enough in the project. This limited our ability to do A/B testing or track immediate ROI post-launch.

- Scalability of the RTE Panel Design: As new carriers and coverage types are added, the current design may need updates to handle overflow or new logic—something we could have stress-tested further in early rounds.

- Post-Launch Customer Awareness: We could have done more to market the feature to existing customers after release. While the feature delivered real value. long term limited visibility may have slowed broader adoption. A coordinated enablement effort with Customer Success and Marketing could have amplified awareness and usage.

Marcus White

Home

Bold Penguin

Real-time quote eligibility

Context

Bold Penguin’s core quoting platform, (aka Terminal) enables commercial insurance agents to quickly quote and bind policies from multiple carriers through a single, streamlined digital platform. It requires users to complete every carrier questionnaire before seeing any quotes—a friction point for agents managing multiple carriers.

Problem

Agents were abandoning applications due to the time and effort required without seeing any payoff (quotes).

Goal

Increase application completion rate and speed by showing real-time quote eligibility as users progressed.

Role

Product Designer

Team:

1 Product Designer

1 Design Manager

1 Product Owner

1 Director of Product 1 Engineering Team

Timeline:

Q2 2022

Final result preview

View Live Prototype

Discovery

What we started with

- A rigid, linear quoting process where agents had to complete all carrier question sets before seeing any quotes.

- High abandonment rates and frustration among agents due to lack of transparency and unnecessary work.

- A feature (real-time quote eligibility) that had been sitting in the backlog for over a year.

What was created and the thought process behind it

- Mapped out the existing application journey to visualize bottlenecks.

- Identified user pain points through internal interviews and analytics: too many steps, no quote visibility early, and wasted effort.

- Proposed introducing real-time visibility into the quote eligibility process by unlocking carrier quotes dynamically as relevant data was entered.

What we delivered

- Initial hypotheses around skipping carriers, and early flows that would allow faster decision-making and less friction.

Initial Design Review

What we started with

- Key design problem: how to allow agents to skip or jump between carriers without breaking logic or creating confusion.

What was created and the thought process behind it

- Designed two user flows:

- Traditional path with all carriers filled out.

- Optimized path with skippable carrier question sets.

- Created early mockups showing:

- How carrier cards would behave in the Real-time Eligibility Panel (RTE).

- What quote statuses would look like (e.g., incomplete, skipped, pending, quoted).

- Considered future edge cases like multi-product quotes (e.g., GL + WC from one carrier) and tackled vertical space constraints.

What we delivered

- A working prototype and conceptual framework for:

- Skipping carrier sets.

- Jumping between carriers.

- Grouping multiple quotes from one carrier into a single expandable card.

- A strong foundation for stakeholder review and usability testing.

Feedback Design Review

What we started with

- A high-fidelity prototype demonstrating:

- Carrier skipping.

- Real-time updates to the quote panel.

- Early attempts at status indicators and user flows.

What was created and the thought process behind it

- Conducted 6 feedback sessions (participated in 5) with enterprise clients including InsureCherokee.

- Gathered direct user insights:

- Skipping to competitive carriers was highly praised.

- Request for showing estimated pricing sooner.

- Suggestions for grouping by carrier and clarity on multi-coverage display.

- Iterated based on feedback:

- Simplified visual hierarchy.

- Enhanced iconography and label clarity.

- Removed clutter by consolidating coverage types into single cards.

What we delivered

- A refined, clickable high-fidelity prototype that:

- Addressed agent pain points around speed and control.

- Was visually clear and aligned with Bold Penguin’s brand and technical constraints.

- Was validated by enthusiastic user feedback and cleared for engineering build-out.

Final Outcome & Results

View Live Prototype

What was shipped

- Launched a new Real-Time Eligibility (RTE) Panel inside the Bold Penguin Terminal.

- Enabled live carrier quotes to populate dynamically as users filled out relevant fields—no need to complete all question sets first.

- Delivered full functionality to:

- Skip non-competitive or unnecessary carrier question sets.

- Jump between incomplete and completed carriers.

- View grouped multi-coverage quotes within a single carrier card.

- Built with edge-case handling for:

- Incomplete carriers.

- Error messaging and quote timeouts.

- Returning to edit responses and retrieve new quotes.

The business value

- Conversion Rate

- Minutes to quote for The Traditional Path: 9 min, 38 seconds average.

- Minutes to quote for The Modern Path: 2 min, 56 seconds average. (70% reduction in time in Q4 2022)

- Feature Adoption Rate

- Total application starts in Q4 2022: 20,607

- The Traditional Path we defined as the status quo: 19,577

- The Modern Path we defined as the new feature: 1,030 (5% pilot feature adoption rate)

- Longer term Feature Adoption Rate

- Total application starts from Q1 2023 - Q2 2025: 124,709

- The Traditional Path we defined as the status quo: 103,513

- The Modern Path we defined as the new feature: 21,190 (17% sustained average feature adoption rate)

- Helped Bold Penguin strengthen its position as an efficient quoting solution in a competitive insurtech market.

The user value

- Time to First Value (TTFV):

- Improved the agents' time to first value by reducing quote delivery time within the application by 70%

- Empowered agents to:

- Focus on competitive carriers early in the process.

- Save time by skipping low-value carriers.

- Increased clarity and confidence for agents with a clean, informative quote display.

- Enhanced usability and accessibility via simplified flows, clearer iconography, and flexible navigation.

The data supporting the value delivered

- Application time-to-quote reduced by 70% in Q4 2022 which significantly improved our agents' ability to complete applications faster.

- Positive user sentiment from 6 research sessions, with multiple mentions of increased speed and usability.

- From Q1 2023 - Q2 2025, the Feature Adoption Rate reached its highest at 22% in Q2 2024 and sustained at an average rate of 17% percent throughout the pass 3 years of usage.

Reflection

What worked well

- Stakeholder Alignment: I learned how to build trust with multiple stakeholders, from product leadership to engineers. Clear prototypes and a collaborative mindset helped secure buy-in at key decision points.

- Problem-Solving in a Complex System: Navigating a multi-carrier, multi-product quoting flow required deep understanding of edge cases. Our solution simplified a notoriously complex process into something scalable and intuitive.

- User-Driven Design: Participating in five out of six customer feedback sessions allowed me to integrate user insights directly into the iteration loop, which led to greater adoption and satisfaction.

What could be improved

- Earlier Involvement of Engineering in Design Decisions: While we collaborated well overall, some engineering edge cases surfaced late. Looping in developers sooner during ideation could have reduced refinement time later.

- Quantifying Impact Sooner: We didn't define our success metrics (like quote yield, time-to-quote) early enough in the project. This limited our ability to do A/B testing or track immediate ROI post-launch.

- Scalability of the RTE Panel Design: As new carriers and coverage types are added, the current design may need updates to handle overflow or new logic—something we could have stress-tested further in early rounds.

- Post-Launch Customer Awareness: We could have done more to market the feature to existing customers after release. While the feature delivered real value. long term limited visibility may have slowed broader adoption. A coordinated enablement effort with Customer Success and Marketing could have amplified awareness and usage.